A second wave of COVID-19 has put Australia’s staged reopening and recovery on hold in some states. Across the nation, cash flow is front of mind for every business. But if you’re a start-up or scale-up, finding consistent capital and cash flow for R&D is more than a priority. It’s essential.

So what are your options to access capital and incentives to keep your R&D pulsing in the new financial year?

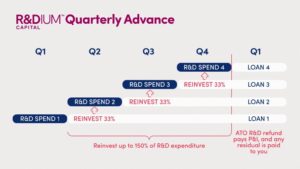

Bridging capital to boost your R&D

Since the current crisis took hold, Radium Advances have been a financial lifeline for businesses with R&D. So much so, that Q4 of the 2019-20 financial year was our busiest yet. We’ve been willing and able to help more of Australia’s innovation-based businesses than ever before. Now in its sixth month, there’s no end in sight for economic fallout from the COVID-19 crisis. And this has created a capital and cash flow squeeze like no other. At the turn of the new financial year, steady cash flow and capital for R&D has never been more crucial.

It goes without saying that innovators must have access to capital to keep their R&D moving. Radium Capital is playing a vital role to fill this funding gap. Radium Advances can be used as bridging loans for R&D. By connecting businesses with R&D capital in a few business days, Australian innovators can avoid waiting months for their refunds, and keep their R&D on track instead. So if your R&D capital is threatening to dry up, don’t hit pause on your projects. Whether you’re a new or existing client, get in touch on 1800 723 486. We’ll help you explore the option to use a Radium Advance as bridging finance for your business.

Potential changes to the R&D tax incentive

Changes could be on the cards for the R&D tax incentive. And these might see Federal Government plans to pare back the refund become a reality. The Senate will not vote on any proposed changes until August, at the earliest. The plans have met with significant resistance from many stakeholders. We believe, as Australia faces its worst health and economic crisis in a century, this is no time for the government to walk back support for innovation. So we’re working hard behind the scenes to push for more support—rather than less—for Australian R&D. But if the proposals the government has tabled are triggering more uncertainty for your business, remember the maximum loan-to-value ratio on a Radium Advance is 80% of your tax refund. And our clients typically have some of their refunds left over even after they’ve repaid their advance, interest and arrangement fee.

However, if you’re at all concerned, seek advice from your R&D tax adviser on what’s best for your circumstances. It’s also worth noting that at the end of March, the government extended the deadline for 2018-19 R&D tax incentive claims to 30 September 2020. So if you have R&D from 2018-19 that’s eligible for the R&D refund, you could apply for a Radium Advance to access your money this quarter. This way, your FY 18-19 refund is safely beyond the reach of any retrospective measures touted under the government’s proposed amendments.

Innovators must have access to capital to keep their R&D moving, and Radium Capital is playing a vital role to fill this funding gap.

Grants, incentives and other sources of capital

When it comes to doing R&D in a pandemic economy, taking an eclectic approach to sourcing capital is the safest bet. Here are some sources of capital worth checking out for your business.

SME coronavirus guarantee scheme 2.0

Earlier this year, the government unveiled the Coronavirus Small and Medium Enterprises (SME) Guarantee Scheme. It supports up to $40 billion of lending by participating lenders to SMEs and runs until 30 September 2020. This month, the scheme got an extension and a bit of a makeover too. Now, businesses with turnovers of up to $50 million can get a government guarantee of 50% for new, unsecured loans for working capital. The maximum loan size is $250,000 per borrower. Loans can be for up to three years and feature a repayment holiday for the first six months. These loans are unsecured, so SMEs don’t have to put up an asset as security. From 1 October 2020, eligible lenders will be able to offer loans under version 2.0 on the same terms as the current scheme with these enhancements:

- Loans can be used for a broader range of business purposes, including to support investment in a period of economic recovery.

- The maximum loan size will increase to $1 million per borrower.

- Loans can be for up to five years and options for a six-month repayment holiday will be at the lender’s discretion.

- Loans can either be unsecured or secured (except in the case of commercial or residential property).

The updated scheme will run until 30 June 2021.

New Instant Asset Write-Off 2.0

The Federal Government increased the instant asset write-off threshold from $30,000 to $150,000. It also expanded access to include businesses with an aggregated annual turnover of less than $500 million (up from $50 million). This new take on an existing scheme applies from 12 March 2020 until 31 December 2020. It covers new or second‑hand assets that are first used or installed, ready for use, during this time period.

But starting from 1 January 2021, the instant asset write-off will revert to a threshold of $1000 for small businesses with a turnover of less than $10 million.

Entrepreneurs’ Programme

The Federal Government’s Entrepreneurs’ Program helps researchers, entrepreneurs and SMEs commercialise their innovations. It’s open all year round and provides support in the form of capital grants and expert advice. Under the program’s Accelerating Commercialisation Grants, ventures can access up to 50% of expenditure on a project. Commercialisation offices and eligible partner entities have their grants capped at $250,000. But the ceiling is $1 million for other applicants. Find out more information on the Entrepreneurs Program.

Export Market Development Grant

If you’re scaling up with export markets in your sights or shocks to supply chains from the pandemic have opened up overseas opportunities, this could be the grant for you. Administered by Austrade, recipients must spend their own money upfront before seeking this reimbursement. On eligible promotion expenses, SMEs can get back as much as 50% on outlays over $5000. But the total amount claimed must exceed $15,000. Eligible businesses can put their hands up for a maximum of eight grants. The maximum amount a business can receive in its initial payment is $60,000. The grant year runs with the financial year. Find out more about the Export Market Development Grant.

Maintain and nurture your human capital

People are the heart of any business. Let’s look at what the government is doing to help companies maintain and grow their human capital and resources.

JobKeeper 2.0

The JobKeeper wage subsidy program to help businesses keep staff launched in March and was designed to run for six months. But a new wave of COVID-19 and the continuing economic ripple effects from the start of the pandemic triggered a rethink. Enter JobKeeper 2.0. This second iteration of the government scheme has an end date of 28 March 2021. Gone is the much-feared financial cliff foreshadowed for September. But it’s not all rosy in the garden. The top two takeaways from JobKeeper 2.0 are that fewer businesses will be eligible, and those that qualify will have to pay a higher proportion of their wage bills.

JobKeeper 2.0 will take effect after 28 September, ushering in a number of modifications.

Key changes for businesses doing R&D:

- There will be two tiers of JobKeeper payments, that will decrease over the six months between October 2020 and March 2021.

- Employees working less than 20 hours per week will receive the lower-tier payment with the higher-tier rate reserved for those working more than 20 hours each week.

- The higher-rate payment will be $1200 per fortnight from October until early January.

- From 4 January the higher tier payment will decrease from $1200 to $1000 a fortnight until 28 March.

- For employees working less than 20 hours a week, JobKeeper payments will reduce to $750 per fortnight after September, and then drop to $650 per fortnight from January through to March.

- Turnover eligibility tests will be reapplied twice; once in September and again next January.

- To continue to qualify, businesses with an aggregated turnover of $1 billion or less must prove their turnover has fallen 30%, while businesses with turnovers of $1 billion or more have to show a drop in turnover of 50%.

- To be eligible for JobKeeper 2.0, businesses also need to show they experienced turnover declines in all previous quarters, not just the one they are claiming for.

Spotlight on skills training

The Federal Government’s $1.3 billion wage subsidy scheme to support small businesses with apprentices and trainees has been extended.

The government is pumping a further $1.5 billion into the program, pushing its end date back to 31 March 2021. And now medium-sized businesses with fewer than 200 employees and an apprentice in place on 1 July will also be able to claim the 50% wage subsidy.

This program is definitely one to watch if you have trainees or apprentices working in your business or on your R&D.

Certainty in uncertainty lies ahead

So long as potential vaccines and effective treatments for COVID-19 are still in question, uncertainty is the certainty we have for the months ahead. For start-ups, scale-ups and businesses with R&D, maintaining steady cash flow is the best antidote. If we can help you with a Radium Advance, or if you’d like to discuss the R&D tax refund, please contact us directly on 1800 723 486 or request a call from us today.