The COVID-19 pandemic has turned all aspects of our lives upside down, and business cash flow is no exception. The good news is your business is not powerless against the economic impacts of the virus. There are steps you can take to shore up your cash flow and safeguard your business.

When it comes to cash flow, it’s fair to say there are typically a couple of objectives. You want your business to have operating, investing and financing cash flow. And whether you’re turning a profit or not, you want this cash flow to be positive.

Chances are the coronavirus pandemic just blew out your timeline on being cash flow positive, if you weren’t there yet. And if you are turning a profit, this crisis has no doubt thrown a spanner in the works. But whether your business was cash-flow positive or negative pre-crisis, it’s essential to pay close attention to your cash position now. Seek fresh sources of capital and cut or defer any costs you can. Effectively, you want to increase the money coming in and decrease the cash flowing out.

Here are our tips to help you manage the current capital and cash flow crisis. Let’s start by looking at some new ways to cut your company’s outgoings during the pandemic.

1. JobKeeper Payment

Through the JobKeeper Payment scheme, the government has committed to paying $1500 a fortnight per employee to employers and eligible sole traders. Applications opened on 20 April and will close at the end of May. This scheme is well worth considering if you’re a sole trader, or a start-up with highly-skilled employees you can’t afford to lose.

To qualify for access to JobKeeper Payments, as an employer, a few conditions apply:

- Your business must either have an aggregated turnover of less than $1 billion and have experienced a 30% decrease in revenue, or have a turnover of $1 billion and more, and have lost 50% or more of your revenue.

- For employers, large and small, you must show an employment relationship with your employee(s) on 1 March 2020. The employees you claim the JobKeeper Payment for must be currently employed by you.

If you’re a sole trader, you must meet the turnover test that applies to employers, and not be a permanent employee of another business. You can apply through the ATO’s Business Portal using your myGov ID or through your registered tax professional. Learn more about how to qualify for Jobkeeper Payments.

2. Pay less tax

The new Instant Asset Write-Offs and accelerated depreciation through the Backing Business Investment scheme are two new ways to cut your company’s tax bill.

The Instant Asset Write-off Scheme has been around for a while. In a nutshell, it allows eligible businesses to immediately write off the cost of a new or second-hand asset up to a threshold amount. Companies can then claim a tax deduction for the business portion of the cost of buying the asset in the year it’s first used, or installed and ready for use.

Now with the coronavirus pandemic, the government has a new take on this old scheme.

From 12 March 2020 until the end of the current financial year:

- The threshold amount for each asset has increased fourfold from $30,000 to $150,000.

- More businesses are eligible for this tax write-off. Now companies with revenue of up to $500 million can apply where previously only those with turnovers below $50 million were eligible.

The Backing Business Investment scheme is a 15-month investment incentive designed to provide a short-term boost for business investment and economic growth. It works by speeding up depreciation deductions and applies to eligible assets acquired from 12 March 2020 that are first used or installed by 30 June 2021.

Businesses with turnovers of less than $500 million can deduct 50% of the cost of an eligible asset when it’s installed. And existing depreciation rules will still apply to the balance of the asset’s purchase price.

3. Mandatory commercial tenancy code

You’re stopping the spread of COVID-19 by social distancing and working from home whenever you can. But how do you distance yourself from the cost of your mothballed business premises?

In early April, the National Cabinet addressed this issue for businesses that lease premises by bringing in a new national code for commercial tenancies.

The code covers businesses eligible for JobKeeper Payments that also have turnovers of less than $50 million, and a revenue decrease of 30% or more.

Here are the scheme’s key takeaways:

- Your lease can’t be terminated for non-payment of rent.

- Your rent can’t be increased during the COVID-19 pandemic.

- Rent waivers and deferrals linked proportionally to your loss in turnover are available.

- If your lease is due for renewal, you can have it renewed for 24 months or longer, with rent reductions and deferrals included.

- Your landlord can’t charge you any extra interest or penalties or access your bond in lieu of rent payments during the pandemic.

- Your landlord must pass on any benefits or relief received during the pandemic, for example, from banks (in the appropriate proportion).

- As a tenant, you must remain committed to your lease.

The government has pushed back the deadline for 2018-19 R&D tax incentive claims from 30 April to 30 September 2020 to help businesses hit by the COVID-19 pandemic.

Cutting costs is one side of the cash flow equation. Let’s consider how you can increase the amount of capital flowing into your business to stave off the current slump.

4. SME coronavirus guarantee scheme

The Coronavirus Small and Medium Enterprises (SME) Guarantee Scheme supports up to $40 billion of lending by participating lenders to SMEs until 30 September 2020. The scheme includes sole traders.

Businesses with turnovers of up to $50 million can get a government guarantee of 50% for new, unsecured loans for working capital. The maximum loan size is $250,000 per borrower. Loans can be for up to 3 years and feature a repayment holiday for the first six months. These loans are unsecured, so SMEs don’t have to put up an asset as security.

5. R&D tax incentives changes

The government has pushed back the deadline for 2018-19 R&D tax incentive claims from 30 April to 30 September 2020 to help businesses hit by the COVID-19 pandemic, or recent bushfires. Now is the time to check if you had any eligible R&D last financial year, and lodge a claim by 30 September. It can be in addition to any R&D offsets your business has this financial year.

If you think you’re eligible for the tax refund, make sure you’ve registered your research with the Department of Industry, Science, Energy and Resources.

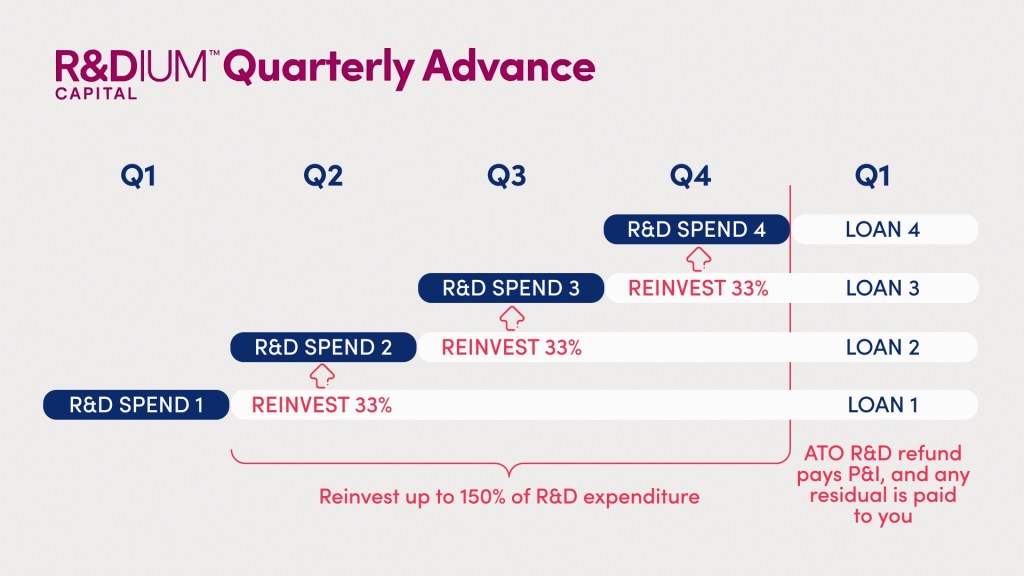

And if you do qualify for the R&D refund, it’s a good idea to access this capital and cash flow as soon as possible using an R&D advance. Radium Capital will support you to get the funding you need if you apply for a Radium Advance.

If you’ve explored the R&D tax incentive in the past and found you weren’t eligible; it’s still worth discussing with your accountant and checking again now.

The government’s response to the fast-moving COVID-19 pandemic is evolving, constantly. So we recommend you keep a close eye on the latest announcements about Federal Government assistance and monitor support measures your State Government is providing.

And of course, if you’d like to discuss the R&D tax refund, or how we can help you with a Radium Advance, please contact us directly on 1800 723 486.