As we ushered in the new year last month, it was no ordinary milestone. The arrival of 2020 was not only the start of another year but the dawn of a new decade. If you wondered how technology would bound forward over the next 10 years, you weren’t alone. But if you also wondered how your business might form part of that story, read our analysis and tips for companies with an innovation focus.

The story so far…

The Federal Government publication, Australia 2030: prosperity through innovation, found that two major trends dominated the first two decades of the 21st century:

- The rise of firms from emerging markets, such as China and India.

- The shift to technology-driven businesses, for example, digital disruption.

What’s next, and how can we achieve it?

As we advance towards 2030, Australian businesses will need to scale, innovate and become more productive to thrive. The Federal Government’s vision is public and private sectors working together to develop novel ways of financing innovation and managing risk to help make this happen. While research and development (R&D) advances are an excellent example of this vision in action, what else can Australian businesses do to make innovating, scaling and thriving their reality?

It’s all about the money, money, money…

Or, more accurately, access to capital and cash flow – the fuel that drives your research activities. Without consistent cash flow, even programs supporting the most promising innovations will stall.

Depending on your business type or industry, you may be able to choose from an array of R&D grants and incentives. The downside of grant funding is it can be a lottery, and it’s intermittent. And this could mean a long-time between drinks for your research program.

The Federal Government R&D tax incentive scheme, on the other hand, is the single, largest program supporting Australian R&D regardless of sector. Australian businesses of all shapes and sizes are investing in R&D – an estimated $34 billion last financial year. However, only around 13,000 businesses are claiming the R&D refund and just 27.6% of start-ups, according to Startup Muster.

Must-haves for R&D in 2020

Here are our five simple tips to maximise your R&D and innovation strategy in 2020 and keep that all-important cash flow flowing.

1. Make sure you’re claiming the R&D refund.

It sounds basic, but we can’t say this enough. Make sure your R&D activities meet the strict eligibility criteria so you can apply for this tax refund.

Your research must be classified as either “core R&D” activities (based on principles of science), use proper scientific methods and create new knowledge) or “supporting R&D” activities undertaken to advance core R&D. Check out our blog on R&D refund eligibility. You can also find out more about the R&D tax refund here.

2. Don’t wait or hesitate.

Apply for an R&D advance. When 31 December rolled into 1 January, it not only marked the end of 2019 but the half-way point of the financial year. So, get your capital and cash flow moving this year with an R&D advance on your R&D spend to date. If you’re eligible for the R&D refund, then you’re eligible to apply for a Radium Advance.

Unlike other R&D advances, Radium Advances allow you to access and reinvest your refund throughout the year. Follow a few easy steps, and you could be applying for up to 80% of your refund. Our platform approach means we can approve your advance within two business days and transfer funds to you three days after you sign your loan documents. To learn more about Radium Advances, check out our product information.

3. Advance, advance again, then advance some more.

They say practice makes perfect. And it is definitely the case when it comes to Radium Advances.

The more frequently you bring forward your R&D refund, the more it benefits your business.

Under the Federal Government’s rules, there’s no annual limit on the number of times businesses can bring forward their R&D refunds.

A business spending $100,000

on R&D, this financial year can bring forward up to $34,800 of their R&D refund for H2

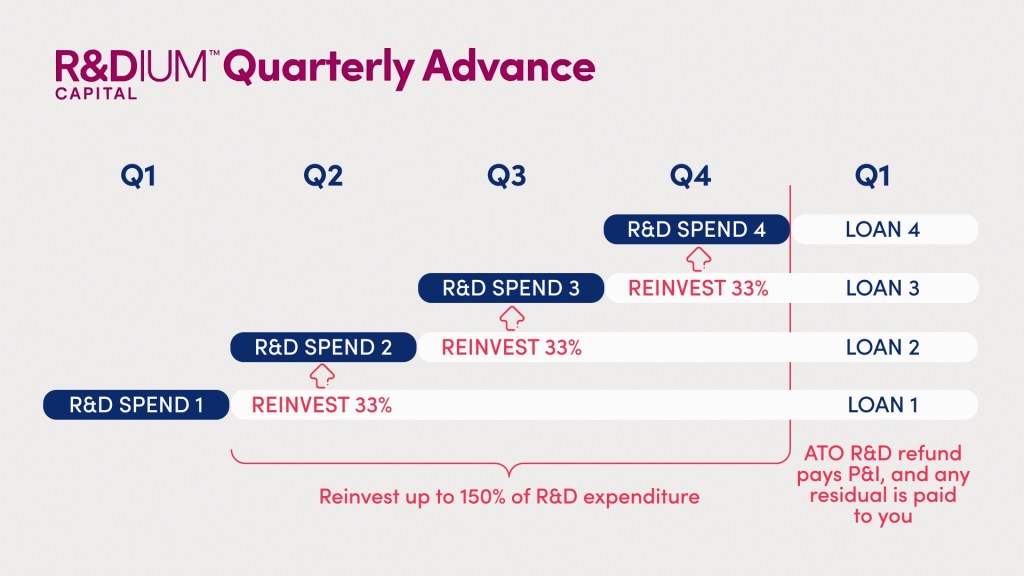

Each time you use an R&D advance, it triggers additional refunds, so it makes sense to do this more than once a year. With the Radium Quarterly Advance model, you can either increase R&D spend by up to 50% or reduce R&D capital outlay by up to 33%. It’s up to you. But if you haven’t applied for a Radium Advance this financial year, now is the time. With your Q2 Business Activity Statement deadline just around the corner, you’re in the best position to know what your R&D spend is so far this year.

4. Keep control of your business.

There’s no doubt about it, running a successful R&D program takes capital and continuous cash flow. Traditional funding options such as bank loans are often out of reach for start-ups or early-stage businesses with R&D programs, so it can be tempting to raise dilutionary capital. But you could end up giving away your business before it takes off.

To avoid this, set some time aside in early 2020 to find out where you can access non-dilutionary capital. Check out which government grants and programs are available to you. The government has also expanded its incubator support program to fund incubators supporting first-generation migrants and refugees who are establishing start-ups with the potential to commercialise in overseas markets. And don’t forget Radium Advances offer your business non-dilutionary capital because the only security we normally require is your Australian Tax Office refund (ATO).

5. Avoid upfront costs and expensive fees

It’s vital to keep control of costs across your business, especially if you’re working on R&D. Carve out some time to look at your costs, and how they impact your cash flow. Make adjustments that will smooth your cash flow and benefit your business. At Radium, we pride ourselves on offering smart capital solutions. That’s why we make sure there are no upfront costs and no loan repayments for a Radium Advance until your business receives the full ATO refund.

If you’d like to get your business off to a good start this year, think about bringing forward your R&D refund for the first half of the financial year. Check out our calculator to see how much you could access now, or get in touch to find out more.