Sooner or later, most R&D start-ups will need to raise capital. The process can be challenging at the best of times, let alone during a recession. And after months chock-full of uncertainty, there’s no sign of the finish line for this crisis. So, what’s the best strategy when it comes to that all-important capital raise for founders? And once you raise capital, how do you get maximum bang for your buck?

To raise or not to raise—that is the question

Timing can be everything in business, especially if you’re in the R&D game. For start-ups and scale-ups, the rapid spread of coronavirus and abrupt change in market sentiment was a curveball. So whether— back in March— you were mid-raise, months away from your next funding round, or your runway was longer (say 18-24 months), what should you do now?

If you don’t need to raise capital in the near future, it could be tempting to ride out the pandemic. Raising money when the recovery begins may seem like the better option.

But experts such as Sequoia and Wholesale Investor have warned of a prolonged period of volatility. Although capital markets have retreated, this trend is set to continue and is yet to reach its peak. According to Wholesale Investor’s Steve Torso, the pandemic is the time to double down on your efforts to raise capital, whatever your runway. Sequoia Capital’s Roelof Botha says, the chaos of a crisis creates opportunity and urges start-ups to lean in, and take advantage of opportunities that emerge from the pandemic.

Capital raising in an ever-tightening market is a tough gig. Torso points out that in Australia, there are more start-ups and scale-ups than ever before. And now, they’re looking for capital as the nation heads into its first recession in nearly three decades.

Boost your chances of getting funded

So what’s the best way to make your business stand out and get angel investors and venture capitalists on board despite the pandemic?

1. Leverage your network

If you’ve got investors and haven’t reached out to them yet, it’s time to pick up the phone. Your current backers have skin in the game. They have a vested interest in your business succeeding. Prioritise keeping them informed and ensure you’ve delivered on any commitments or obligations you have to them.

Next stop is your existing network and hitting up any warm leads. At a time, when much of the world is working remotely, and face-to-face meetings are a rarity, the odds of making a deal are higher with people who already know and trust you. Getting recommendations and warm introductions to would-be backers for your business are always valuable. So don’t be shy about asking your contacts for this type of support.

2. Keep cold pitches on the agenda

If and when you’ve exhausted your existing network, it’s time to consider cold pitching to investors. Target those that are a good fit for your business. You may find investors are more open to receiving an unsolicited approach because lockdowns and restrictions mean they can’t travel or spend time in face-to-face meetings.

3. Work it, here, there and everywhere

Whether you’re leveraging your network or pitching cold, prepare to buckle down. Venture capital experts like Torso are advising founders that they’ll need to work three times harder and speak to three times as many investors than they previously would have.

But the flipside of lockdowns, travel restrictions and remote working is you can meet with investors from all over the world digitally—from the comfort of home. Armed with a laptop and a killer slide deck, you could open doors that may otherwise have been closed to you before COVID-19.

4. Get visible & collaborate

Take every opportunity to get your name, your business and ideas out and into the funding ecosystem. Develop a marketing plan for your business to improve your visibility to potential investors. Look at your options to generate PR for your business and its innovations. Accept offers or ask to be a panellist or guest speaker on webinars or other online events. Consider joining forces with peers from your network who work in adjacent industries. Collaborating could enable you both to strengthen your value propositions.

5. Prepare to negotiate

This is where the rubber really hits the road. Make sure you know what your game plan is when it comes to investors. With supplies of capital declining and more founders chasing it, investors are well and truly in the box seat. Expect to give concessions you wouldn’t have pre-pandemic. But that doesn’t mean you need to compromise unreservedly. Remember, if an investor is seriously considering funding your business, they value your R&D and are banking on your future growth and success. Make sure you don’t compromise on your core purpose and values and that any ground you give is not going to cost you and your business irreparably in the long-run.

If you’ve got investors and haven’t reached out to them yet, it’s time to pick up the phone.

The alternatives if a capital raise isn’t an option

With uncertainty—the nemesis of economic growth—continuing to stalk investors and capital markets, a capital raise might not be possible for your business right now. Let’s look at your other options to access the capital you need to emerge on the other side of the COVID-19 crisis.

Bank loans

Even when the economy is booming, getting a bank loan for R&D can be a tough gig for start-ups and scale-ups. The government’s Coronavirus Small and Medium Enterprises (SME) Guarantee Scheme is designed to tackle funding gaps for SMEs. This scheme has recently been extended to 30 June 2021. So if you haven’t already explored this option for your business, there’s still time to do so. And if you have no joy accessing the scheme through a traditional bank, try SME fintech lenders Moula and Prospa. They’re also permitted to lend under the scheme.

Grants and incentives

A few grants and incentives that could help your start-up or allow you to scale your business include:

The R&D tax incentive

If your R&D is eligible for the Federal Government R&D tax incentive refund, you can currently claim back up to 43.5% of your expenditure. If you think you’re eligible for this tax refund, make sure you’ve registered your research with the Department of Industry, Science, Energy and Resources.

Entrepreneurs’ Programme

The Federal Government’s Entrepreneurs’ Program is designed to help researchers, entrepreneurs and SMEs commercialise their innovations. Ventures can access up to 50% of their project’s expenditure under the program’s Accelerating Commercialisation Grants. But this is capped at $250,000 for commercialisation offices and eligible partner entities and $1 million for other applicants.

Export Market Development Grant

SMEs can recoup as much as 50% on outlays over $5000 through the Export Market Development Grant. The total amount claimed must exceed $15,000. Eligible businesses can apply for up to eight grants. The maximum amount a company can receive in its initial payment is $60,000.

Alternative finance

From crowdfunding to online lenders, alternative finance has been going from strength to strength in recent times. And these sources of capital should be front of mind for any businesses with R&D. With their new take on capital, cash flow, security, fees and charges, alternative finance is a breath of fresh air for start-ups and SMEs looking to scale.

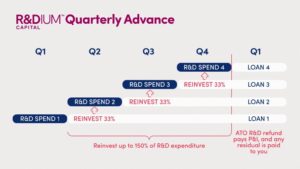

You’ve got your money, now what?

COVID-19 has taught us why it’s so important to make every dollar in your business go as far as possible. If you do qualify for the R&D refund, it’s a good idea to access this as soon as possible with an R&D advance. Getting a Radium Advance can help your businesses with that all-important R&D capital and cash flow. With your documentation in place, a Radium Advance will let you access up to 80% of your tax refund in a few business days. Reinvest in R&D, and trigger more refunds to make those R&D dollars go further, or use your Radium Advance to boost your cash flow instead. The choice is yours. If you’d like to discuss the R&D tax refund or apply for a Radium Advance, please contact us directly on 1800 723 486 or request a call from us today.