No two innovation businesses are alike, and neither are their funding needs. Depending on the type and stage of your business, your goals and even your risk appetite, you’re likely weighing up different options for funding growth, from raising equity and applying for grants to taking on debt or continuing to bootstrap.

Each of these comes with trade-offs around timing, control, flexibility, and growth potential. That’s why many businesses look for options that can sit alongside one another and adapt as their needs evolve. Many innovative businesses are leveraging early access to their accruing Research and Development Tax Incentive (R&DTI) refund to inject capital exactly when they need it. Known as R&D finance, this approach provides a flexible, non-dilutive source of finance that can be built into a broader capital strategy.

At Radium, we deliver this early access through Radium Advances. They are a powerful flywheel to support growth and innovation goals. In this blog, we’ll explore eight practical use cases that show how innovative companies are putting their Radium Advances to work.

What is an R&D Advance?

If you’re already claiming or are eligible for the Federal Government’s Research & Development Tax Incentive (R&DTI), a Radium Advance is a simple loan which allows you to access your accruing refund ahead of tax time. The money is yours to use how you want to in the business, to suit your business goals. The money is non-dilutive, flexible and certain. Plus, R&D finance is a form of capital accessible even to early startups, which might not have the assets and progress traditional lenders and funders would require.

From startups and scaleups to ASX-listed companies, businesses across sectors, states and stages use Radium Advances to improve cash flow and strengthen their capital position. Radium Advances can be used how and when you want. Some businesses use them to provide a one-off cash injection at a critical moment. Others build them into their funding rhythm to support ongoing R&D. While quarterly access is common, you can set the cadence and frequency of your advances.

That flexibility shapes how businesses use R&D finance in practice. Broadly, innovative businesses tend to apply it in two ways: to reduce how much of their own capital they need to deploy, or to deliberately reinvest and compound R&D expenditure to accelerate growth. In reality, many businesses use a blend of both approaches to suit their evolving needs.

Use less of your own money to meet your goals

We understand that cash flow can be tight, especially if you’re just setting out on your innovation journey, are in a period of rapid growth, or want to jump on an unexpected opportunity. But when R&D forms the foundation of your business, it’s not an area you can scale back.

By accessing a Radium Advance, you can maintain your business’s planned R&D spend while reducing how much of your own capital is tied up at any one time. That frees up working capital to support other priorities in the business.

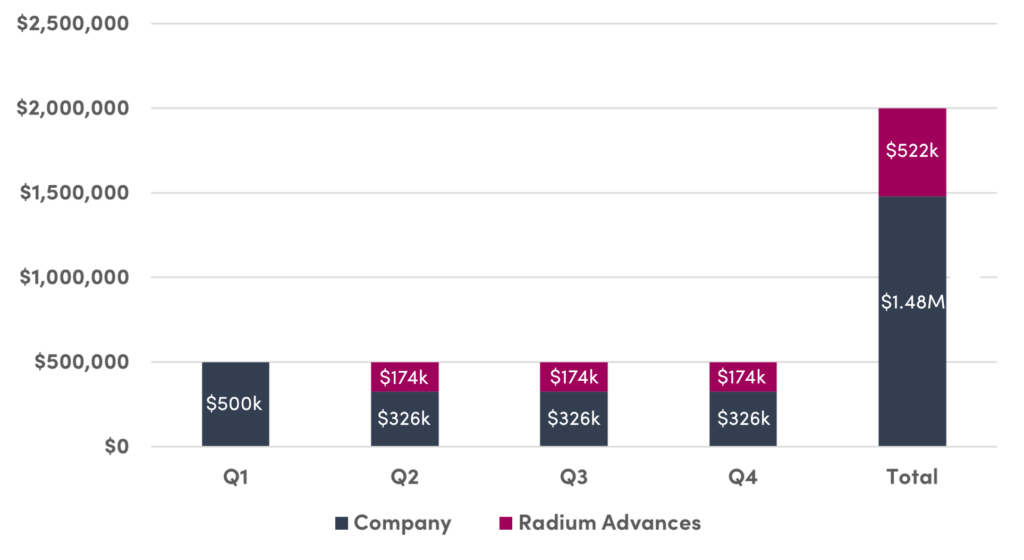

The graph below illustrates how this works in practice. This company plans to spend $2 million on R&D this year. But instead of funding its annual $2 million R&D program from its own working capital, the business contributes $1,478,000 across the year, with $522,000 accessed through a series of Radium Advances. In Quarter 1 the business spends its planned $500,000 on research, then brings its expected R&DTI refund forward with a Radium Advance. That advance is $174,000, which means the company can spend $326,000 of their own capital on R&D in Q2, with the Radium Advance filling the funding gap to bring the total quarterly investment to $500,000. They do the same for Quarters 3 and 4, meaning they were able to reduce their capital outlay by 26% while maintaining the same R&D budget.

Structured this way, R&D finance becomes a cash flow management tool, allowing you to deliver your planned innovation program while freeing up capital to use elsewhere in the business.

Compound and grow

Compound and grow

In other situations, the objective isn’t to reduce capital outlay to fund innovation projects — it’s to increase R&D investment. Instead of using a Radium Advance to ease pressure on working capital, a business can reinvest that funding directly into its R&D program to grow their R&D budget. Because the R&DTI refund is calculated as a percentage of eligible R&D expenditure, increasing that expenditure increases the size of the future refund.

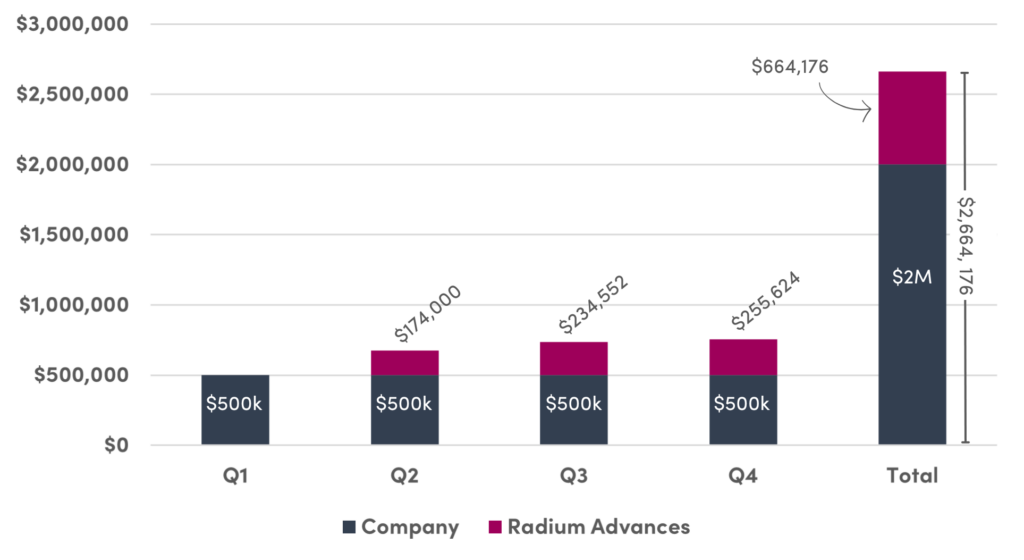

When advances are accessed regularly — for example, on a quarterly basis — that effect can build over time. Each advance supports additional R&D spend, which in turn increases the next advance calculation. Used strategically, this creates a compounding benefit. The graph below illustrates this approach.

In Quarter 1 the business invests its planned $500,000 into R&D, then brings its R&DTI refund forward with a Radium Advance. It then reinvests this $174,000 advance into R&D, on top of the $500,000 it had already planned to spend, boosting available capital to $674,000. In Quarter 2, they benefit from the compounding effect of reinvesting their advance into R&D, with a $234,552 advance that is then reinvested into the Quarter 3 research budget. And so on. By the end of the year, the business has boosted its $2 million R&D budget by a total of $664,176, or 33%. That extra spending can be used to accelerate timelines or pursue new research opportunities.

Used consistently, this approach turns your R&DTI into a growth lever, helping you compound your innovation progress quarter after quarter.

Eight practical use cases for R&D finance

We’ve worked with founders and leadership teams at innovative companies across Australia for more than nine years, deploying over $1 billion in R&D funding. As Australia’s leading provider of R&D finance, we’ve seen it used differently across sectors, stages and business models to meet businesses goals. Here are 8 of the most common ways Radium Advances are being built into capital strategies today.

Use Case 1: Bridging a funding gap

As the end of the financial year approaches, businesses often look for bridging finance to maintain R&D momentum. Cash flow crunches can also occur throughout the year, for example when a funding round takes longer than expected to close, a customer is late paying a large invoice, or an expected grant falls through. When this happens, short-term loans in the form of R&D financing can provide a much-needed capital boost. Companies can use the funding to keep their R&D projects moving forward, or to cover other business expenses until their expected R&D tax refund arrives, or other sources of funding come in.

Sustainable mining-tech innovator ElectraLith CEO Charlie McGill says Radium’s funding gave the company crucial breathing room while its Series A funding round was being finalised. “Radium helped us when we were in a very tight situation and through that we were able to keep the technology progressing, and ultimately keep the investors and partners happy.” ElectraLith went on to raise A$27.5 million in an oversubscribed round and was named as one of the World Economic Forum’s top innovators in 2025 and earnt a place on the Global Cleantech100 list in 2026.

Companies often first engage Radium for short-term bridging finance before switching to a strategic R&D financing model that features regular advances throughout the year. Intelligent commerce platform tapestry® first accessed a Radium Advance to keep vital R&D moving when VC funding was hard to come by. But CEO Christopher Bartlett says R&D finance – what he calls “smart capital” – is now an essential part of his company’s balance sheet, “I wish that I had known about it sooner. When things are getting tight, people look for other options. Now that we know about it, we will do it indefinitely.”

Use Case 2: Accelerate R&D and get to market faster

When being first in market counts, finding ways to boost your R&D budget can be a gamechanger. Whether you’re working in medtech, green tech, or creating a brilliant app, spending more on R&D can help you get your big idea from the bench to bedside and beyond, faster. WA biotech SeaStock set out to create a methane-reducing livestock feed additive from a native algae, but quickly realised they could make many more products from the same base ingredient. The company needed to accelerate R&D to develop and commercialise more products and expand internationally, so used regular Radium Advances to boost their R&D budget. CFO Tim Whyte says, “With Radium’s support, we haven’t had to take our foot off the pedal, and we’ve been able to keep pushing through our R&D milestones.”

LOVE TO Growth Group needed a way to maintain momentum as it developed an ecological assessment system and financial token to help measure and value ecological improvements. Founder Tim Bennett says they tapped into a Radium Advance to increase the company’s overall R&D spend and maintain progress, “Without our Radium Advances, it would have taken us twice as long to achieve our R&D goals, and we may not have completed our urgent work to help safeguard the planet.”

Use Case 3: Hire the right people at the right time

Whether you’re a startup or an ASX-listed firm, having a strong team is vital. From attracting the right executives for an international expansion, or hiring the leading specialist in your field of research, access to capital can make or break your ability to appoint the right talent. Using an R&D Advance to maintain your R&D program while freeing up cash for other areas of the business can help your recruitment strategy and can fund hires. Depending on your R&D spend, accessing your R&DTI return early can literally mean more headcount. Christopher Bartlett says tapestry’s Radium Advances represent at least an extra salary, “R&D is the investment you make in the future and the growth of the business. And R&D funding has added extra staff members.”

Use Case 4: Buy equipment to meet critical timelines

Sometimes you need funding fast to scale up operations. That’s exactly the situation Gold Coast-based biotech Southern RNA found themselves in when asked to create personalised vaccines for a world-first paediatric cancer trial. With the trial rolling out nationwide this year, Southern RNA needed fast capital to accelerate the capability of their Gold Coast and Brisbane vaccine manufacturing facilities. They were already using Radium Advances, and Managing Director Chris Peck says their latest Advance will enable the company to move at speed. He says, “It’s just-in-time funding that’s allowing us to buy the equipment needed for the GMP facility to produce the vaccine for the trials.”

Use Case 5: Capitalise on new opportunities

Innovation moves quickly, and successful founders make the most of strategic opportunities, whether that be a new customer segment, a new market, or a new partnership. But if your budget is already fully allocated, you need a source of ready capital to invest in increasing capacity. Startups and scaleups often run on shoestring budgets and may not be ready for investment capital, or may not want to give away equity too early. That’s when R&D finance can provide the funding boost you need to jump on the new opportunity and take your business to the next level. When green mining technology company Nimble Resources was selected to join the Think and Act Differently (TAD) challenge (powered by BHP), they suddenly needed an injection of capital to deliver on the opportunity. With their R&D budget already committed, they needed a top-up to progress their research and move towards commercialising their air-based mineral-extraction process. Managing Director Gregory Dore says R&D finance offered a funding lifeline that avoided having to dilute equity, “Radium Advances gave us the breathing space we needed to focus on completing more R&D and lab work faster so we could commit to the TAD partnership and timelines.”

For biosecurity platform developer Avicena Systems, Radium Advances enabled the business to keep progressing without disruption. CEO and cofounder Tony Fitzgerald says, “Accessing financing ahead of our tax refund provided a capital buffer to pursue new opportunities in industry sectors with longer contract lead times and payment term.”

Use Case 6: Smooth uneven cash flow cycles

For innovative businesses, cash flow rarely moves in neat, predictable cycles. Longer contract lead times, delayed customer payments and the lag between R&D spend and receiving the R&DTI refund can all create pressure, even when the underlying business is performing well. Building strategic, regular R&D Advances into your budget can help smooth these uneven cycles by bringing forward capital that your business is already entitled to, creating predictability and breathing room. As SeaStock CFO Tim Whyte says, “It’s a really valuable tool to manage your cash flow and for strategic financing.”

Health-tech developer Movendo experienced periods of uneven cash flow that slowed its R&D investment and innovation progress. Director Jose Mantilla says once the business discovered Radium Advances they began accessing their R&DTI refund early at regular intervals throughout the year, “Radium Advances let us breathe easier and give us the certainty we need to plan our R&D investment and accelerate our innovation.”

Use Case 7: Delay or optimise capital raising

Raising capital requires more than a strong pitch deck. It takes time, focus and sustained effort from founders and leadership teams, often exactly when the business needs them focused on innovation, execution and growth. Whatever stage your business is at, timing a capital raise carefully can improve your company’s valuation and limit how much ownership you dilute. Using R&D finance to fund your innovation can help you stay focussed on building the business, and raise capital at the right moment. Radium Advances have allowed construction technology company NXT TEC. to concentrate on product development, customer growth and reinforcing the underlying drivers of long-term value. Chairman and Managing Director Natasha Di Ciano says, “Regular Radium Advances enable the company to focus more effectively on our R&D, rather than diverting resources toward continual capital raising for R&D activities.”

In the early days, or between rounds, accessing your accrued R&DTI refund can help you stretch existing capital and continue progressing your innovation without additional dilution. It may even allow you to avoid an early-stage raise altogether, giving you time to advance the technology, strengthen commercial traction and build the foundations that support a stronger valuation. Raising before those foundations are in place can result in a lower valuation and greater dilution than necessary. For health tech company Oqea, Radium Advances allowed them to scale up and expand their diagnostic decision-making tool for mental health practitioners ahead of a planned capital raise. Managing Director and CEO Martyn Weir says, “Radium Capital’s non-dilutive R&D advances have enabled us to accelerate our R&D and choose when we raise capital from investors.”

Importantly, using R&D finance strategically can also strengthen your position in the eyes of investors. Using non-dilutive funding demonstrates capital discipline and a considered approach to ownership. Being approved for R&D finance can act as a vote of confidence, signalling that the company has credible R&D activity and a structured funding strategy in place. Medtech innovator NeedleCalm found that having Radium Advances as part of their broader funding mix made conversations with new investors more constructive and commercially focused. Founder and Managing Director Lauren Barber says, “When you use R&D finance, investors look at it favourably and realise that you’re being quite smart with your money and not just giving away equity.”

Just as importantly, incorporating R&D finance into your capital stack can buy time. That’s time you can use to identify the right investor, negotiate appropriate terms and ensure alignment on strategy and direction. For NXT TEC., maintaining ownership alignment has been a priority as the company scales, and Natasha Di Ciano says, “Radium provides reliable funding which helps to limit potential equity dilution and allows us to maintain greater ownership alignment as we grow.” Rather than raising under pressure because runway is tight, R&D finance allows you to wait until you are ready to approach investors deliberately and negotiate from a position of strength.

Use Case 8: Prepare for your exit from Day 1

If selling your business is part of your long-term plan, it’s important to lay the groundwork early. The funding decisions you make in the startup and scaleup stages directly shape what that outcome looks like, and how much you benefit from it.

Each time you raise equity, you give away a portion of ownership. That can be the right move. But if equity is your only source of funding, you may find yourself more diluted than expected by the time you exit. R&D finance and other non-dilutive funding options allow you fund development, extend runway and strengthen your capital position without giving up more of your company than necessary.

As companies prepare for an acquisition or exit, maintaining momentum matters. Buyers want to see progress — particularly in R&D-led sectors, where pipeline strength, IP development and product readiness underpin future value. If innovation slows in the lead-up to a sale, it can weaken your negotiating position. R&D finance can help you stay on track. Instead of slowing down to conserve cash, you can continue investing in R&D, hitting milestones and strengthening your growth narrative.

When MeshAssist was developing and spinning out AI-powered mental-health platform Simpatico Ai, they chose R&D finance to fund their R&D without diluting the new company. Cofounder and CEO Alistair Wardlaw says, “Before you consider investor capital, look at Radium Advances to leverage your start-up’s R&DTI refund and fast-track your growth.”

When you do sell, holding a larger ownership stake means you’ll be in a stronger financial position. It can also mean you have more influence over the timing and terms of your exit, because you’ve maintained more control along the way. If an exit is part of your strategy, build that thinking into your funding model from the beginning. A diversified capital mix that includes non-dilutive funding can help you grow today while protecting more of your future.

Using R&D finance with intent

R&D finance works best when businesses plan for it — not when they reach for it in a crunch. As these use cases show, a Radium Advance isn’t just a short-term fix. It’s a flexible, non-dilutive funding tool that can be built into your capital stack at any stage of growth.

Whether you’re using an advance to stretch your budget, smooth cash flow, accelerate commercialisation or buy time to hit a critical milestone, the value lies in how deliberately you use it. Some businesses access R&D finance once, at a pivotal moment. Others make it part of their funding rhythm, building in regular advances to support their business goals.

The most successful innovators don’t wait for pressure to force a decision. They use R&D funding proactively — to stay in control, keep momentum, and fund growth on their own terms.

Leave a Reply

You must be logged in to post a comment.