We know that innovation requires significant investment in research and development (R&D), and it is not only scientists driving the innovation. There are currently around 10,000 companies Australia-wide claiming the Federal Government R&D tax refund.

Eligibility

A company should check with their accounting firm if they are eligible for the R&D tax refund and register their R&D with the Department of Industry, Innovation and Science within 10 months after the end of their company’s income year.

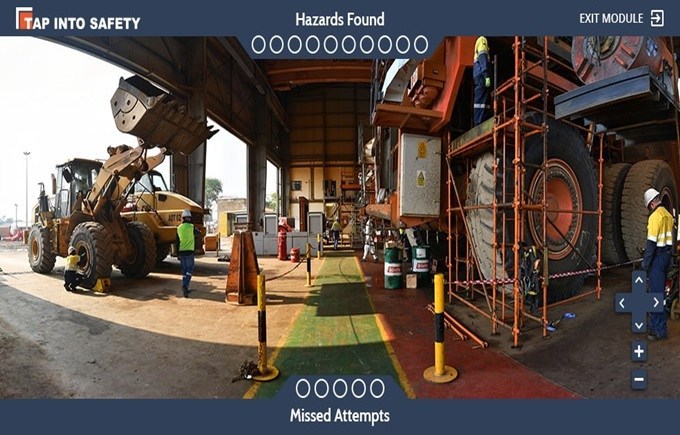

While the program is well known in the start-up space, it is still surprising the number of companies not aware there is a government refund available for their R&D investment. One such company, which has benefited from the R&D tax refund, is Tap into Safety – an early-stage business in the preventative and interactive health and safety and mental health space. After noticing a gap in the market, the company developed a customised, interactive health and safety training platform which teaches and tests safety knowledge, hazard awareness, as well as mental health and wellbeing strategies.

The company’s two software solutions (Hazard Insight and All of Me) combine interactive technology and modern learning practices to produce a methodology focused on the individual’s workplace.

Since its inception, Tap into Safety has been taking advantage of the R&D refund to develop and commercialise its products. Tap into Safety Director and CEO Dr Bahn described the Federal Government scheme as ‘phenomenal’ for incentivising innovation but said the lag time between expenditure and refund penalised smaller companies with limited or no cash-flow.

This is where Radium Advances are helping to accelerate innovation, by solving critical cash flow issues often seen in small innovation companies. In 2016, an independent review of the R&D tax refund recommended quarterly payments, however, the government has yet to deliver on this recommendation.

How Radium Capital can help?

Radium Quarterly Advances are quarterly advances based on eligible R&D expenditure in the preceding quarter, for up to 80% of the company’s expected refund from its eligible R&D expenditure. That money can be reinvested straight back into further R&D. For a small company, this has a massive impact on cash flow and total working capital requirements. It is a private-sector solution to an industry-wide issue.

“Ultimately a key reason industry was calling for quarterly refunds, and why an advance is such a good product, is it avoids the need to raise too much capital too early,” Dr Bahn said. “An R&D advance has meant we did not have to raise capital, and give away value, earlier than we wanted to.

“Early in a company’s life you prefer not to raise, and rely on grants, refunds and the three ‘Fs’ – family, friends and fools.

“You don’t want to raise too much until you have built a solid platform and some consistent revenue, otherwise you end up with a ‘Shark Tank’ scenario where you’ve given away control of the company for a few hundred thousand dollars before your idea takes off.”

There are thousands of innovative companies answering the government’s call for Australia to be an ‘innovation nation’. But most businesses undertaking this R&D don’t have a lot of if any, revenue or access to pools of working capital.

If your R&D program could benefit from a Radium Advance, call us on 1800 723 486 or email us to find out more about applying.