Traditionally considered a type of ‘alternative financing’, R&D financing has more recently become a mainstay of the capital and cash flow mix for innovation businesses conducting R&D activities. We’ll dive into what R&D financing is, why businesses are choosing it and the different financing models organisations use to support their innovation goals.

What is R&D Financing? And why has it become popular?

R&D financing is a type of loan that uses your future R&D Tax Incentive (RDTI) refund as collateral. For businesses claiming the RDTI, the time from R&D expenditure to receiving the RDTI refund can be up to 18 months. R&D financing helps unlock that expected refund in a few business days – allowing you to access your own money when you want it most.

Speed and timing are key reasons why R&D financing has become increasingly popular over recent years, but ease and accessibility are other attractive draws.

Securing capital remains one of the toughest challenges and barriers to innovation for Australian businesses of all sizes. Often start-ups and early-stage businesses don’t tick the boxes for traditional bank loans and other financial products. But at Radium Capital, we believe businesses with R&D should have access to capital when they need it. So we created the Radium Advance to enable businesses to unlock their tax refunds sooner. Because Radium doesn’t think like a bank, we see security differently. By lending against expected RTDI refunds, we can offer R&D funding to businesses that may struggle to secure financing through traditional routes.

If you’re eligible for the RDTI refund, you’re eligible to apply for R&D financing with Radium Capital. Our online, proprietary platform makes applying for a Radium Advance a quick, easy and intuitive process as well.

But, perhaps one of the most cited reasons customers give for choosing R&D financing is that these loans are non-dilutionary. With R&D financing, you don’t need to raise capital or sell shares to boost cash flow. This allows you and your current stakeholders to keep hold of more of the business you have worked so hard to build.

And, depending on how you use R&D financing, the benefits abound. We’ll examine the different models and ways that businesses are using R&D financing. You can also explore customer stories and case studies to find out how Radium customers are applying their R&D funding in practice.

The Cash Injection Model

R&D financing can be accessed as a one-off lump sum to provide a cash-flow injection. There are a number of scenarios where this type of financing is appealing for businesses:

- Commonly around Q3/Q4, we see businesses looking for bridging finance as cash flow for the year starts to dry up. These short-term loans can provide a much-needed boost of capital to keep R&D projects moving forward (or to cover other business expenses) until the expected RDTI refund arrives. It’s not uncommon for companies to first engage Radium for short-term bridging financing before moving to a strategic R&D financing model in subsequent years.

- For R&D projects which have come to an end, and where there is no ongoing need for R&D investment, a one-off Radium Advance is an attractive option as it can unlock the RDTI refund and enable those funds to be reinvested back into other areas of the business.

- Under the Temporary Full Expensing scheme, organisations are currently permitted to accelerate the depreciation of certain assets while still claiming them under the RDTI. For organisations investing heavily in eligible assets, gaining early access to the RDTI refund through R&D financing is another key attraction.

- Or some companies are simply looking to boost their cash balance

While a one-off R&D financing event offers many benefits to businesses, the opportunity increases with regular advances. The more you use Radium Advances, the more your business and R&D can benefit.

There are three popular strategic R&D financing models that we see clients with regular, rather than one-off Radium Advances use: the R&D Reinvestment Model, the R&D Budgeting Model and the R&D Budget-Stretcher Model.

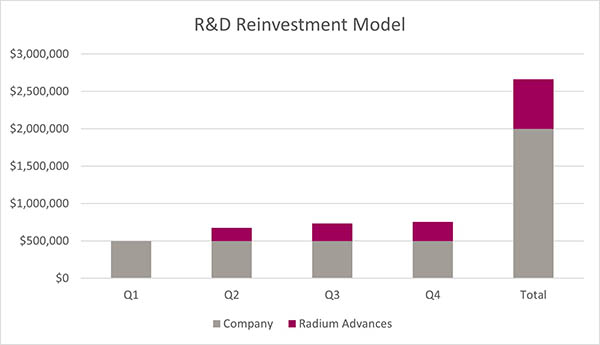

R&D Reinvestment Model

Under the reinvestment model, organisations advance their expected R&D and reinvest it back into R&D, boosting their R&D budgets.

In the above graph, our example company planned to spend $500k each quarter on R&D. By using Radium Advances each quarter the company was able to increase its planned expenditure by 33% or $664k.

As this model helps increase R&D expenditure, it is particularly attractive to customers that are looking to accelerate projects and get to market faster. This model is especially relevant for cutting-edge industries or where a first-mover advantage is to be gained.

ASX-listed Recce Pharmaceuticals is a prime example of a Radium customer that used this model. Our comprehensive case study delves into Recce’s success story and shares real numbers.

And, while one of the key attractions of Radium Advances is that they are non-dilutive, they are also non-exclusive and complementary to other forms of capital raising. Many of our customers will use Radium Advances to help attract other sources of funding, or to provide additional runway while funding rounds are finalised. Most investors are looking to invest in companies that take a proactive, long-term approach to create sustainable levels of growth. A healthy and well-funded R&D program can help to prove that you have that kind of company.

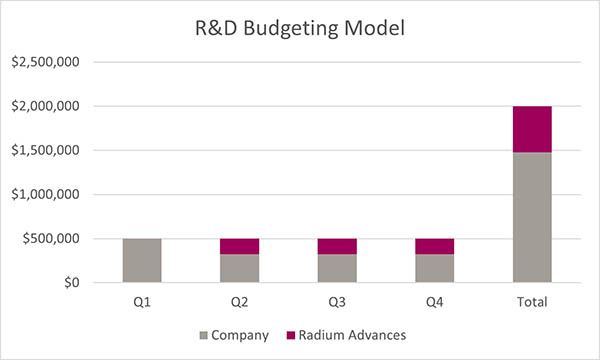

R&D Budgeting Model

Under the R&D budgeting model, organisations advance their expected R&D and reinvest it back into R&D, reducing capital outlay.

In the above graph, our example company planned to spend $500k each quarter on R&D. By using Radium Advances each quarter, the company was able to reduce the amount of outlay needed to cover its planned R&D expenditure by 26% or $522,000.

By reinvesting Radium Advances back into R&D to fund the planned R&D budget, more cash flow is freed up for other parts of the business and supporting activities. And for companies that are looking for other sources of funding to meet their R&D budget needs, this model can mean businesses need to raise less capital.

The R&D Budgeting model can work particularly well for businesses with longer-term R&D projects requiring consistent R&D expenditure.

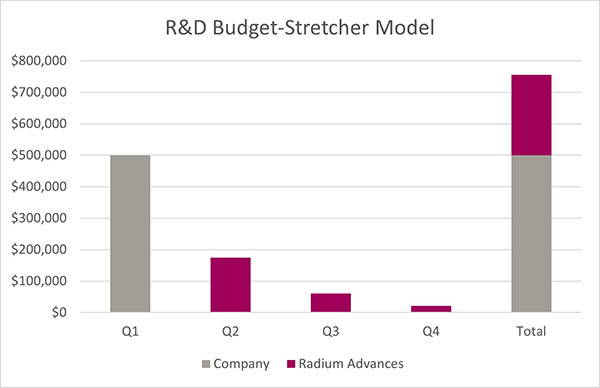

R&D Budget-Stretcher Model

Under the Budget Stretcher model, organisations advance their expected R&D and reinvest it back into R&D, stretching their R&D budgets.

In the above graph, our example company planned to spend $500k on R&D. By using Radium Advances each quarter, the company was able to increase its planned expenditure by 51% or $256k.

This model is similar to the R&D reinvestment model, except that the organisation is relying solely on Radium Advances to fund its R&D projects throughout the year. This model can be beneficial for businesses that expect the majority of R&D activity to occur in a set period or for early-stage start-ups wanting to squeeze every last drop out of their available R&D budget.

Your money, how you want it

Simply put, R&D financing allows you to access your own money when and how often you want it. There are no limits on how many Radium Advances you can receive, and you aren’t restricted on the timing of each loan. Once you have spent money on R&D, you can advance up to 80% of your expected R&D tax refund with Radium. We have assisted a variety of clients, from those with large, short-term projects that advance every 2 – 3 weeks to clients that use Radium Advances twice a year whenever they have spent a set amount.

Ultimately, how you use your Radium Advance – whether it’s for cash flow, following an R&D financing model, or a hybrid approach – is decided by you and your business needs.

Getting Expert Advice

At Radium Capital, R&D financing is all we do. We’ve deployed over a quarter of a billion dollars in R&D funding to hundreds of Australian innovation companies. From entrepreneurs with a flourishing idea to ASX-listed companies, we work with organisations of all sizes, R&D stages and budgets, and from all industry verticals.

As part of our service, our team of R&D finance experts work with you on an individual basis to understand your business and R&D ambitions. That way, we can help determine the cadence and R&D financing model that will best support your goals.

Chat to one of our experts today on 1800 723 486 or request a callback.

Use the Radium Calculator to find out how much you could borrow and applicable fees and charges.