Cast your mind back to a time before COVID-19. Picture yourself hard at work. It’s the financial year 2018-19. Were you doing research that’s eligible for the R&D tax incentive? If you were and you haven’t claimed your refund yet, don’t despair. There is still time. But the clock is ticking. You’ve got until the end of this month (30 September) to file your request.

Squeeze out every last cent

When the economy hit the skids back in March, the government switched into rescue mode to help an economy blindsided by the pandemic. For businesses with R&D, the government pushed out the deadline for 2018-19 R&D tax incentive claims by six months from 30 April to 30 September 2020. At the end of March, when this welcome reprieve was announced, September seemed a long way off. Now the deadline is weeks away. Make sure you don’t end up being a day late and a dollar short. Check for any eligible R&D from the 2018-19 financial year that you haven’t already claimed for. If you think you’re eligible for the tax refund, make sure you’ve registered your research with the Department of Industry, Science, Energy and Resources. Then lodge your claim quick sticks.

Now the deadline is weeks away. Make sure you don’t end up being a day late and a dollar short.

Be crystal clear on your entitlements

If you’ve explored the R&D tax incentive in the past and found you weren’t eligible, it’s worth revisiting. Check your position with your accountant. That way you’ll be 100% confident the tax office will pony up everything you’re owed. And remember, claiming your refund for FY18-19 doesn’t affect your claim for FY19-20 or the current financial year either. But requesting your R&D tax refunds will benefit your business cash flow. It could also help provide capital to up the ante on your research and steal a march on your competitors when you most need to.

Steady your cash position with R&D financing

So you’ve registered your 2018-19 research and made a successful claim to the Australian Tax Office. Don’t let the grass grow under your feet. Cash flow and capital have always been critical for businesses with R&D, but the current crisis has thrown this into sharp relief. Use R&D financing to bring forward your tax refund, so you’re not waiting months for capital you need now. A Radium Advance can help your businesses unlock fresh R&D capital and extra cash flow. Once your documentation is in place, a Radium Advance will let you access up to 80% of your tax refund in just a few business days.

Choose money that makes money

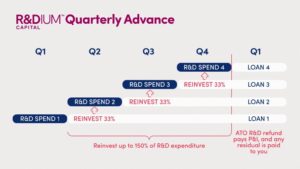

Your tax refund is your money, and so is your Radium Advance. The ball is in your court on how you spend it. You can use your advance to bolster your business cash flow, or you can reinvest it in more research. If you reinvest in R&D, this triggers extra refunds. There’s nothing to stop you from accessing your R&D refund with a Radium Advance more than once a year. Many of our clients choose to get a Radium Advance every quarter. Radium Quarterly Advances mean more tax back. And for the same annual investment, you can either spend up to 50% more on R&D or reduce your outlay by more than 33%.

Other important financial dates for your calendar

The 30 September cut-off for FY2018-19 R&D tax incentive claims is a looming deadline. But there are a few important dates every business with R&D should mark on their calendar to make sure they don’t miss out on government incentives and other cash flow boosts.

1. JobKeeper 2.0 – 28 September 2020

The changes to the government’s JobKeeper Payment (JobKeeper 2.0) will take effect after 28 September. The program has been extended until 28 March 2021. Tiered payments have been introduced, which will gradually reduce over the six-month extension period. Crucially, businesses need to meet two turnover eligibility tests: one at the end of September and one in January to continue to qualify for this support program.

2. Federal Government Budget 2020 – 6 October 2020

In the autumn, Australia was in lockdown. States and territories were battling to bring the nation’s first wave of COVID-19 under control, so the Federal Government cancelled the 2020 Federal Budget slated for 12 May. Instead, it announced an Economic and Fiscal Outlook on 23 July, and 6 October as the new date for the 2020 Federal budget.

3. Senate Economic Legislation Committee Report: R&D Tax Incentive – 12 October 2020

After several delays, the Economics Legislation Committee postponed until the 24 August release of its report into the proposed changes to the R&D tax incentive. Keep a close eye on 12 October. It is the latest release date for the Senate Committee’s findings.

4. New Instant Asset Write-Off 2.0 – 31 December 2020

The Federal Government revamped the instant asset write-off scheme increasing the threshold from $30,000 to $150,000 and expanding access to include businesses with an aggregated annual turnover of less than $500 million (up from $50 million). The revamp is temporary and will run until 31 December 2020. From 1 January 2021, the instant asset write-off will revert to a threshold of $1000 for small businesses with turnovers of less than $10 million.

5. Spotlight on skills training – 31 March 2021

The Federal Government’s $1.3 billion wage subsidy scheme to support small businesses with apprentices and trainees has been extended to 31 March 2021, with the government pumping a further $1.5 billion into the program.

6. Small and Medium Enterprises (SME ) Guarantee Scheme extension – 30 June 2021

The government’s Coronavirus Small and Medium Enterprises (SME) Guarantee Scheme is designed to tackle funding gaps for SMEs. This scheme has been extended to 30 June 2021.

We’re here to help your business and your R&D

As Australia and businesses doing R&D continue to grapple with the worst health crisis and economic conditions in living memory, the months ahead will remain challenging.

If we can help you with a Radium Advance, or if you’d like to discuss the R&D tax refund, please contact us directly on 1800 723 486 or request a call from us today.