As we sprint towards June 30, we’re heading down the home stretch of an EOFY like no other. Finishing a difficult financial year well, and positioning your business for the challenges ahead is essential. So we’ve assembled some useful ideas on how to put your best foot forward and step your business smoothly into FY 2021.

The past six months, with their bushfires and pandemic, have triggered seismic shifts for businesses, markets and everyday life. Balance sheets, cash flow positions and the strategies and plans they underpinned were thrown into turmoil. With the COVID-19 health crisis now contained and the economy starting to reopen, there’s light at the end of the tunnel. But the uncomfortable truth is Australia has fallen into recession for the first time in almost 30 years. Although better times are on the horizon, the months ahead to get there will be hard. Here’s how to take stock at EOFY time and make the onward journey a little easier for your business.

1. Shun spendthrift ways for now

Tempted to splash some cash? There are great EOFY deals on pretty much everything. But channelling your inner skinflint, prior to making new purchases for your business is probably your best strategy right now.

Tempted to splash some cash? There are great EOFY deals on pretty much everything. But channelling your inner skinflint, prior to making new purchases for your business is probably your best strategy right now.

The government’s new Instant Asset Write-Off scheme, framed to support businesses through COVID-19’s economic onslaught, makes it enticing to cross a few items off your company’s shopping list. Businesses with an annual revenue of up to $500 million are eligible.

And they can immediately write off the cost of a new, or second-hand asset up to a new higher threshold amount of $150,000 per asset. Beyond that, companies can also claim a tax deduction for the business portion of the cost of buying the asset in the year when it is first used, or installed and ready for use.

Times are tough and will likely get worse before they get better. The array of attractively-priced EOFY deals and special offers are a symptom of the economy’s poor health. So before you commit to buying assets, remember your company’s resources weren’t unlimited pre-pandemic, and the COVID-19 crisis hasn’t changed that. But what has changed is some of your capital could become uncertain too.

Consider whether any new asset you’re thinking of purchasing will give you a sufficient return or cost saving quickly. An extension to 31 December 2020 for the new Instant Asset Write-Off scheme is on the cards. So you have more time to mull over whether your planned purchases add value. And chances are, come December, the red-hot deals and special offers will still be there.

2. Cash flow is still king

Keeping a favourable cash position has been crucial to negotiating the economic shock of 2020. This is still the case, even though lockdown restrictions are easing and the economy is gradually stuttering back to life. Now is not the time to take your eye off the cash flow ball. Being prudent with your spending is one side of the coin that helps slow the amount of cash flowing out of your business. But it’s vital to explore your options for sourcing more capital inflows too, especially for your company’s all-important R&D activities. Make sure you’ve registered your research with the Department of Industry, Science, Energy and Resources.

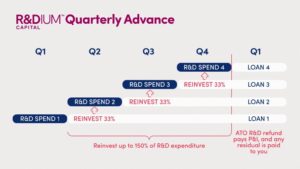

If you qualify for the R&D refund, it’s a good idea to access this capital and cash flow as soon as possible through R&D financing. Our Radium Advances can help you access your tax refund early, so you can use your own money to smooth your cash flow and continue innovating in your business. EOFY is a smart time to apply for a Radium Advance, whether it’s your first advance or you decide to lock in another Radium Quarterly Advance. An EOFY advance will make your cash flow more consistent. It also has a shorter loan term, so you’ll accrue less interest and have more money left over for R&D next financial year. But the clock is ticking on your FY19/20 entitlements, so apply today or get in touch on 1800 723 486. We’ll get you the support you need to apply for your advance before the end of June.

EOFY is a smart time to apply for a Radium Advance, whether it’s your first advance or you decide to lock in another Radium Quarterly Advance.

3. The early bird catches the tax refund

From corona-virus-related incentives to new allowances, tax changes ushered in by the government in response to the pandemic could mean your business qualifies for additional tax relief this financial year. And the sooner you know what you’re entitled to and make a claim, the better. The downside is some extra admin and more time with your tax adviser or accountant. But this is outweighed by the considerable upside of potential extra cash flow for your business as the economy starts its journey into recession. Be sure to seek the professional advice you need. And remember the earlier you file your tax return, the earlier you’ll receive your R&D tax incentive refund and any other tax relief your company is owed.

Innovation holds the key to keeping one step ahead of your competition and aligning your business for new opportunities. If this EOFY, you position your business strategically, you can ride out this recession while keeping your R&D on track. Radium Capital ensures you have the right R&D capital at the right time for your research. We’re here to help you reach your goals, so please feel free to get in touch with us any time on 1800 723 486.